Welcome to our blog post, where we unravel the mysteries of estate planning! When it comes to safeguarding your assets and ensuring that your loved ones are well taken care of after you’re gone, understanding the different types of estate planning is essential. Today, we’ll explore two commonly used terms in estate planning: Per Stirpes and Per Capita. Don’t worry if they sound like Latin jargon – we’re here to break it down for you! So let’s dive in and discover the difference between Per Stirpes vs Per Capita estate planning and why it matters for your future financial security. Buckle up – this is going to be an enlightening ride! Per Stirpes vs Per Capita

What is Per Stirpes Estate Planning?

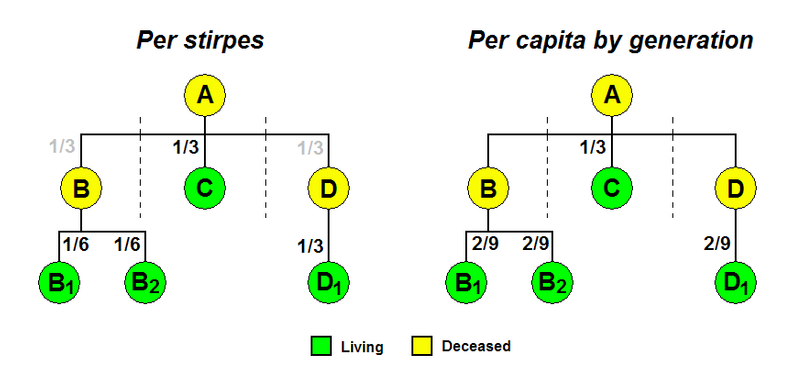

Per Stirpes, estate planning is a method of distributing assets among beneficiaries based on their family line or branch. In simple terms, it ensures that each branch of the family receives an equal share, regardless of the number of individuals in that branch.Per Stirpes vs Per Capita

Let’s say you have two children, John and Sarah. If John has two children and Sarah has three, Per Stirpes distribution would divide your assets equally between these branches. So, each child would receive 50% while John’s and Sarah’s children would split the remaining 50% equally.Per Stirpes vs Per Capita

This type of estate planning becomes particularly important when considering future generations. It allows for a fair distribution even if one branch has more descendants than another. Without Per Stirpes designation, those with fewer descendants could be left with less than they deserve.Per Stirpes vs Per Capita

By utilizing Per Stirpes designations in your estate plan, you can ensure that your assets are distributed in a way that maintains fairness across multiple generations within your family tree.Per Stirpes vs Per Capita

What is Per Capita Estate Planning?

What is Per Capita Estate Planning?Per Stirpes vs Per Capita

Per capita estate planning is a method of distributing assets in an estate plan that ensures equal distribution among all beneficiaries, regardless of their relationship to the decedent. In simple terms, it means dividing the estate equally per person.Per Stirpes vs Per Capita

In this type of planning, each beneficiary receives an equal share of the estate. It doesn’t matter if they are a child, grandchild, or even a distant cousin – everyone gets an equal portion.Per Stirpes vs Per Capita

This approach can be particularly useful to ensure fairness and equality among your heirs. It prevents any one beneficiary from receiving more than others simply because they have more siblings or closer ties to you.Per Stirpes vs Per Capita

For example, you have three children: John, Sarah, and Emily. With per capita estate planning, each child would receive one-third of their assets upon passing.Per Stirpes vs Per Capita

While per capita may seem straightforward and fair, some considerations must be considered. This approach does not consider financial need or special circumstances that might warrant different distributions.Per Stirpes vs Per Capita

It’s important to consult an experienced estate planner who can help guide you through these decisions and ensure that your wishes are carried out effectively.Per Stirpes vs Per Capita

In conclusion, Per capita estate planning provides a clear-cut way to divide your assets equally among beneficiaries based solely on headcount. However, it may not address individual needs or unique situations within your family, so careful consideration should be given before choosing this approach for your estate plan.Per Stirpes vs Per Capita

Why Would I Need Per Stirpes vs Per Capita Estate Planning?

Why Would I Need Per Stirpes vs Per Capita Estate Planning?

When it comes to estate planning, understanding the difference between per stirpes and capita distribution is crucial. These terms refer to how your assets will be distributed among your beneficiaries after you pass away. Per Stirpes vs Per Capita

Per stirpes, meaning “by branch,” ensures that if a beneficiary predeceases you, their share will pass down to their children or descendants. This method allows assets to stay within the family bloodline even if one of the primary beneficiaries is no longer alive.

On the other hand, per capita distribution means “by head” and divides your assets equally among all living beneficiaries at the time of your passing. If a beneficiary dies before you do, their portion is not reallocated but goes directly to the remaining living beneficiaries.

The method best suits your needs depends on family dynamics, age differences among beneficiaries, and desired wealth preservation goals. For instance, per stirpes might be preferable to ensure that future generations receive a fair share of inheritance.

Navigating these complex decisions can be overwhelming without professional guidance from an estate planning attorney. They can help analyze your specific circumstances and tailor an effective estate plan to achieve your objectives.

It’s important to consider who will inherit what and how they will inherit it. By understanding whether per stirpes or capita is more appropriate for you, you can create an estate plan that aligns with your intentions and desires for asset distribution after death.

How Does Per Stirpes vs Per Capita Impact My Estate Plan?

One important aspect to consider when creating your estate plan is how the distribution of assets will be handled among your beneficiaries. This is where understanding the difference between per stirpes and capita comes into play.

Per stirpes, meaning “by roots”, refers to distributing assets that ensure each branch or lineage of the family receives an equal share. If one beneficiary in a particular branch has passed away, their share would then pass on to their children or descendants.

On the other hand, per capita, meaning “by head”, distributes assets equally among all living beneficiaries at each generation level. If one beneficiary passes away, their share is not transferred to their descendants but divided equally among the remaining living beneficiaries.

The impact of choosing either per stirpes or per capita can have significant consequences for your estate plan. For example, if you choose per stirpes and have multiple branches in your family tree, each branch receives a fair share, even if one member has passed away.

Alternatively, opting for per capita may result in some branches receiving more than others if fewer surviving members are within those branches. It also prevents the dilution of shares as additional generations come into play.

The choice between these two methods depends on family dynamics and personal preferences. Consulting with an experienced estate planning attorney can help you navigate these decisions accurately and ensure your wishes are carried out accordingly.

Remember that every individual’s situation is unique; therefore, it’s crucial to carefully evaluate which approach aligns best with your specific circumstances when deciding about your estate plan.

Pros and Cons of Each Type of Estate Planning

Pros and Cons of Each Type of Estate Planning

Per Stirpes, estate planning has its advantages and disadvantages. One major benefit is that it ensures that your assets are distributed to your descendants fairly and equitably, even if some have passed away before you. Knowing that your family’s needs will be addressed can provide peace of mind.

However, one potential downside is the complexity of determining how the assets should be divided among multiple generations. It may require careful consideration and consultation with legal professionals to ensure everything is done correctly.

On the other hand, Per Capita estate planning offers simplicity and ease of distribution. The assets are divided equally among all beneficiaries, regardless of their generational ties or the number of children they have.

One advantage is that this method avoids complications when dealing with multiple generations or families. It can simplify the process for you and your loved ones during a difficult time.

However, it’s important to note that Per Capita distribution may only sometimes result in a fair division if some beneficiaries have more financial need than others. In such cases, additional provisions must be implemented to address these concerns.

The choice between Per Stirpes and Per Capita estate planning depends on your specific circumstances and goals for asset distribution after death. Consulting with an experienced attorney specializing in estate planning can help you navigate these options effectively.

Conclusion

Conclusion

When it comes to estate planning, understanding the difference between per stirpes and capita distribution is crucial. Both methods have advantages and disadvantages, so it’s important to carefully consider your circumstances before deciding.

Per stirpes distribution allows for assets to be passed down through generations, ensuring that each branch of the family receives an equal share. This can be beneficial if you want to include future descendants in your estate plan or have children who predecease you.

On the other hand, per capita distribution divides assets equally among all living beneficiaries at the time of your passing. This method may be more suitable if you prefer a simpler approach or have fewer direct descendants.

To determine which option is best for you, consult an experienced estate planning attorney who can guide you through the process and help ensure your wishes are carried out effectively.

Remember, every person’s situation is unique, so what works for one individual may not work for another. Tailoring your estate plan according to your specific goals and needs is essential.

In conclusion (without using “In conclusion”), choosing per stirpes or capita estate planning ultimately depends on factors such as family dynamics, personal preferences, and long-term goals. By understanding these concepts and seeking professional advice when needed, you can create an effective estate plan that provides for loved ones in the most appropriate way possible.